________________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________

| Business Tech Energy Health Finance Economy |

______________________________________________________________________________________________  ________________________________________________________________________________________________________________________ JUNE 14, 2023 Even though Robin Hood brokerage is in the News for some tactics that many Big Brokerages have been using against Customers: It makes sense to use Robin Hood to buy $BRKA & $BRKB. [Robinhood $HOOD has now started a scam whereby $HOOD sells their Customers' investments, kicks Customers out with prejudice & does not give them money back: It can no longer be said that Robinhood Brokerage is a safe place for investors: The Company is robbing Customers due to severe & complex Cyberattacks: $HOOD allows internal Company scams: Cyberattacks exploit that. As always Investors must do their own research & determine proper allocations & legitimate Brokerages: As of now $HOOD is not a legitimate Brokerage: $HOOD is scamming & stealing, after a $65 million SEC fine for thieving $34 million from their own Customers, through a scam.] This Finance News site does not make recommendations: However the Math is very strongly on the side of long term investment exposure to Berkshire Hathaway. Over time investors should consider allocation to $BRKB & also $BRKA on Robin Hood, the site that allows $1 purchases of stocks. [note: See note in bold above, $HOOD started a new scam of stealing Customers' funds after this article was first published. As of now $HOOD is not a legitimate Brokerage: $HOOD is scamming & stealing] What is ironic, is the fact that while $BRK.A is in the News for complaining about Bitcoin, ultimately it is the success of Bitcoin that has added to Berkshire Hathaway's overall business.

Where as Berkshire was on the News a few years back, stating of Bitcoin "You can have a little ledger sheet" what Computer Scientists did was took that basic, albeit very complex math-based new Branch of Computer Science and ran with it:

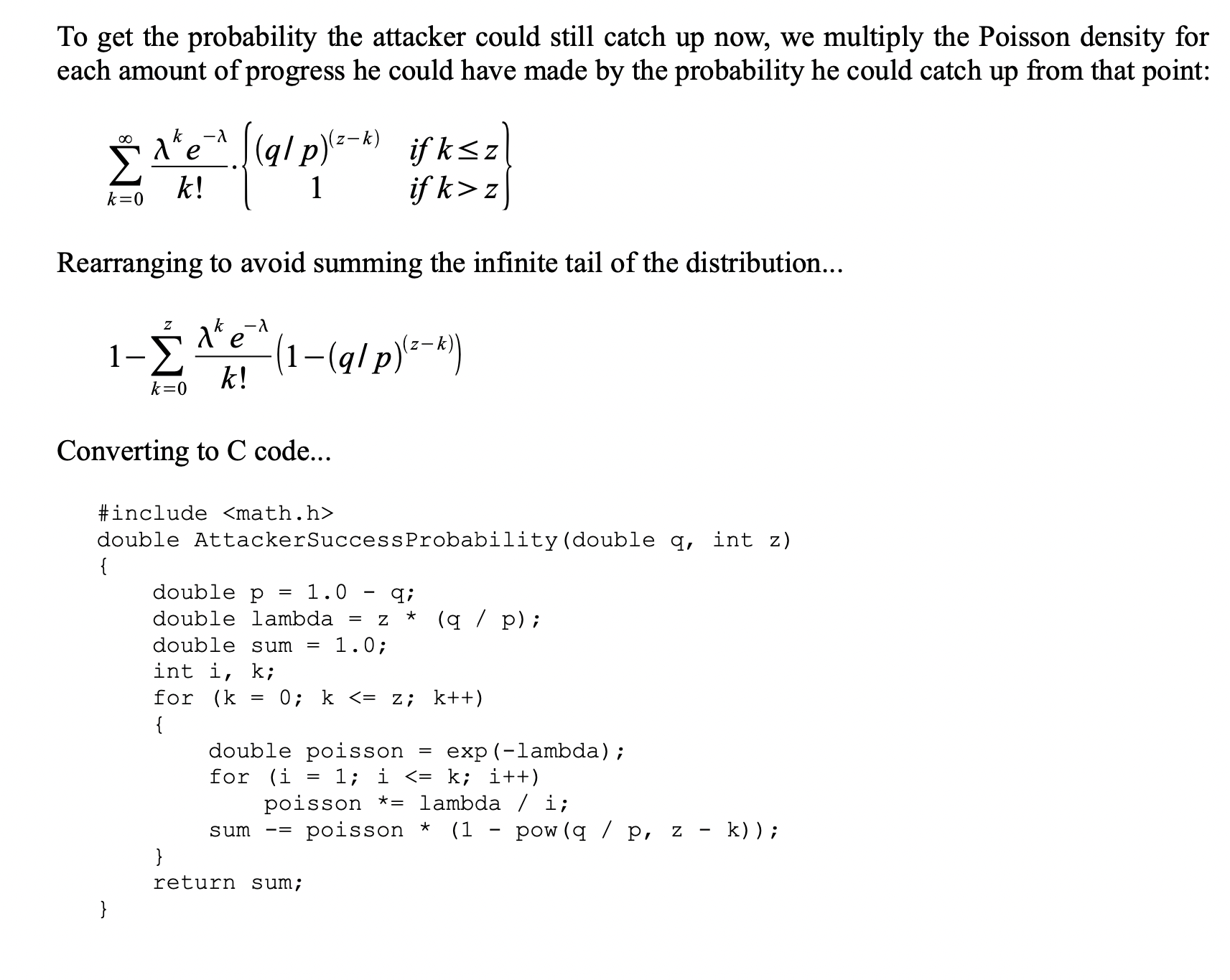

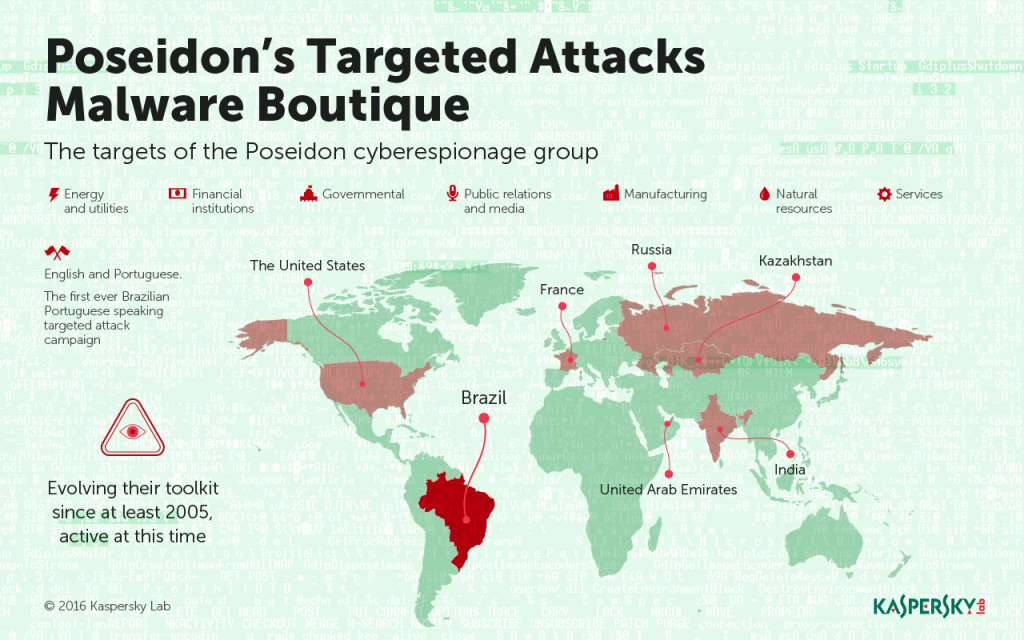

Building up 100s of billions in business from what appears to some: $BRKA on $BTC said: "You can have a little ledger sheet." That "little ledger sheet" has given Coders / Computer Scientists a way to build better Cybersecurity, better Medical Devices & Software, by providing a way for Tech to monetize energy harnessing & the ability to use Blockchain for Software that is valuable, that previously was not done [because there was no value system.] excerpt from $BTC White Paper  So, in the past Software Attacks literally set around for 12 years & more, undetected, in America. $BTC in Cybersecurity, such as $BTC used with Zero Trust can & does begin to make those days a thing of the past.

Regardless, on their own Berkshire Hathaway has built extraordinary value. Both the old fashioned, and also in a very futuristic way. From a centerpiece of Coca-Cola in Berkshire's Portfolio, to large Tech Investments in recent years. Berkshire Hathaway hit $520,000 per share today, and if the same Business Strategy that the company is built on and is using can be sustained [that's an important part] $BRK.A is well on the way to a $1 Trillion dollar market cap. The top Businesses of the day continually learn from Berkshire Hathaway, strong business skills that make the difference between permanence and dysfunction: such as Microsoft, Google, Apple, and even Vanguard a company that has been in the News recently for some Negative News: Vanguard is in the News for their Executives robbing the Customers of millions of dollars; after that Vanguard deployed a scam against Customers and turned off 1000s+ investments, billions of dollars that Customers paid Vanguard millions in commissions on: That Jack Bogle allowed for and accepted millions of dollars from Customers to be able to buy. The new Vanguard Chairman / CEO, Tim Buckley allowed a very corrupt Brokerage Team to deploy a betting scam against Customers, that removes the Customers from the equation of Vanguard Brokerage Teams' bets. This is a newer & common scam, or so it appears:

It turns out that Fidelity has been doing the same thing for many years, however was not as blatant: Fidelity literally pushes their own Customers away, forces them away when the Market goes down & while Customers are leaving, Fidelity's corrupt Professionally Managed Brokerage Team robs $10,000 sums of Cash from the Customers. Fidelity does that to Customers becasue they are betting on Customers' positions & when market goes down if the Customers go away, then they can give them back less than what they originally deposited: Becasuse Fidelity already sold their investments. Once again it's due to Software Attacks against Finance Infrastructure: Both the Customers & the Company are harmed while their Corrupt Brokerage Teams swindle Customers: Due to very complex Advanced Persistent Threat software attacks that are against Finance Infrastructure. It does appear the reason Fidelity, Vanguard, Bank of New York, Chase, Robin Hood all are using similar scams is because of complex software attacks against Finance Infrastructure that worsen any ploys from their own competition. So while Robin Hood even is now in the midst of a Big Scam to rob their own Customers: Turning off $SOL, $MATIC, $ADA: Blockchains that are very valuable & Customers were allowed to buy -- Robin Hood is turning them off & plans on selling them as they did before a few months ago on other Cryptography Based units of value that are part of Blockchain, at Deep Discounts: Where the Blockchains a few months ago bounced right back up after Robin Hood forcibly sold their Customers' positions: A blatant scam where by they are able to sell to themselves then turn around Big Profit minutes later: Even though Robin Hood is doing that it is sensible to use Robin Hood to build up $BRKA positions in non-IRA & IRA. Robin Hood's HQ city reports that Businesses are innundated with software attacks. Over in Michigan the News reports over 180,000 software attacks per day. While some News reports on Bitcoin being targeted by APT Groups [groups that make software attacks] where by some APT groups try to steal other People's Bitcoin, or use Bitcoin themselves Negatively, the many Good Computer Scientists have used this new branch of Computer Science for intelligent and quality Applications and business: That does not make the News The reason Big Brokerages now a days can not make a rule that their Brokerage Teams not scam and rob: Is complicated. Those APT software attacks do up to quadrillions of opeartions per second & are designed to be undetectable. More and more now a days Bitcoin and top Blockchains are used in software that can be of help: In Cybersecurity, due to Bitcoin's Nature of being built upon Computer Science and growing into a Branch of Computer Science. The reason top Brokerages are allowing their Teams to steal is also due to those Advance Persistent Threat software attacks. If it's a scam they think they can get away with, then Vanguard, Robin Hood, Fidelity, Bank of New York, and JP Morgan as of now are using those scams: While their own employees call the companies things like "cult" in their Employee Reviews: That, is characteristic of those software attacks that are very complex.  It was after News of Vanguard Executives stealing millions from dead customers that Vanguard went ahead and deployed a new scam designed to steal / scam millions more: Turning off investments that Customers were allowed to buy: We would not have moved funds into Vanguard if we knew they were going to turn them off. That is a Common Denominator of the various, similar scams at Robin Hood, Vanguard, JP Morgan Chase, Bank of New York & Fidelity: Customers would not have moved their money to those Businesses if they knew they would turn investments off. Vanguard & JPM do that while in the News also for stealing. Now they are all doing that blatantly, it's the result of complex Attack Software; they are all being affected, targeted by those Advanced Persistent Threat software attacks that are not adequately defended against: Some of the Cybersecurity that is able to keep up with those attacks 24/7 uses $BTC $LTC $ETH $ADA $SOL $BCH $MATIC and the Top 45 Blockchains with Zero Trust {$BTC was founded, in part, upon the Trustless Branch of Computer Science: Now $BTC & Top Blockchains are used to strengthen both Cybersecurity & Valuable Good Technology.

The Negative News makes the Headlines whereas the Tech & Science does not. Without some $BTC based infrastructure software designed by the Best of the Best Cybersecurity Experts & Computer Scientists that uses $BTC & the additional Blocikchains they founded & built, Adversaries in the past were & are able to take full control of Devices: Just valuable, valuable tasks that in the past were not tended to: Could have been done, however were not: When that fulfilled the Objectives of those complex software attacks & was purposeful.. While it sounds complicated, one Reason that Robin Hood, JPM, Vanguard, Fidelity & Bank of New York's scams are so blatant & sloppy can be in part due to Software trying to ID areas of weakness: However as of now Customers are being scammed by those Finance Businesses & that is because of the innundation of Advanced Persistent Threat Software that are fighting against strong Finance Infrastructure. Vanguard gave no notice at all, before turning off 1000s+ investments, billions of Customers' dollars in investments they were allowed to buy at Vanguard. Vanguard placed a memo on an obscure "Education" page on their website that most, 99% of Customers were not aware of before on April 28, 2022 Tim Buckley, the new Chairman / CEO of Vanguard, turned off Billions of Dollars of Customers' investments so his Vanguard Brokerage Team could rob & scam  Vanguard Posts < $300M while they turned all those investments off, numerous multi-billion dollar investments that Customers paid millions in commissions to Vanguard to buy. It's a clear, malicious scam by Vanguard: Similar to numerous others at their fellow Finance Companies, because they are all getting the same exact APT software attacks & do not use Protocol or Standards of any kind to prevent Brokerage Teams from robbing & scamming Customers. On the other hand, Berkshire Hathaway has against many challenges been able to remain an excellent Company that is a model for any smaller business to try to live up to. There are Key Statistics that are the Reason for all investors to be looking to Berkshire Hathway: While the company did post lesser earnings recently, it is due to continued efforts to build one of the World's finest companies that focusses on quality business for long term. Investors should consider allocation to Berkshire Hathway Class A through Robin Hood, where they can buy $1 at a time and build up to hopefully 1 share in the long term, though on average most People currently do not have an extra $520,000 laying around to buy 1 share of Berkshire Hathaway Class A: There is a possible future where there will be more Wealth in the World, and more People will have those resources one day. There are no guarantees in business, it is rough and it is a roller coaster: It is strongly possible for Berkshire Hathaway to be able to both reach and then maintain for the very long term a + $1 Trillion market cap: With current market cap around $748 billion on Berkshire Hathaway. [For the math experts in the Crowd multiplying $BRKA times shares outstanding of 585,850: The remaining market cap is in Berkshire's over $400 billion worth of $BRKB Berkshire Hathaway Class B] Long term investors should consider building up over the next 10 years and doing research to find strong Balance for their investments over all: Some add Treasuries, some add Corporate Bonds & Municipal Bonds, some Tech, some Blue Chips to the mix & realize the market is a Roller Coaster: However the success of Quality & Intelligent businesses like Berkshire Hathaway make a more stable future for Global Economies closer to a Reality: For example Berkshire Hathaway gets into the businesses where any one can apply & start making some good money, such as Berkshire Hathaway Home Services. Then there's the wisdom of experience that Berkshire has been able to forge. In 2022 the Federal Reserve raised rates 1000s of % from 0.02 on 12/29/2021 to 4.39 on 12/29/2022 on the "2 Month" and now to over 5% [5.25% today 6/14/2023... from 0.02% in a few months.] That Rate Increase Pace from the Federal Reserve coincided with American Households losing 6 Trillion dollars in 3 months in 2022: It is the same, Software Attacks against the Fed that they are not defended against adequately: With Tweets from Fed as recently as Yesterday that suggest that the Fed's Manual Rate Increases have nothing to do with Consumer Prices, when they definitively do. It's an increase in Finance Sector Scams that is the result of APT Software attacks: $6 Trillion doesn't just all of a sudden get up & walk away: Big Brokerages have been using Federal Reserve & SEC's Actions to deploy scams, more, due to Software against Finance Infrastructure: While Fed raises rates Big Brokerages like Bank of NY deploy scams: Disallowing Customers from selling very liquid bonds $AAPL $GOOGL $AMZN $MSFT $BRKA to name a few Corporate Bonds Bank of NY couldn't find any Orders availble on, when there were 10+ a day: Bank of NY doesn't allow Customers to sell, if they are up. Just blatant, blatant scams & that's characteristic of Complex Software Attacks] With this PoSeidon Software that targets Finance found next door to Vanguard as they deploy scams on their Customers: An APT undetected for over 12 years:  Long term investors have been both severely hurt by that, however there are also opportunities to continue to build up bond ladders with Corporate Bonds & now more with Treasuries as the result of that raise is more yield: Then use the small streams of income to add to Equity like Berkshire Hathway. In order to fully understand any company investors should check the company's Investor Relations and their Filings to gain an understanding of what the Nubmers are to that Business: Berkshire's are found at https://www.berkshirehathaway.com/ Berkshire is currently reporting around 585,850 shares outstanding: Simply incredible. That's the Key Statistic and it's due to brilliant leadership in a very fast paced Business World. There is no question that the new level of $1 Trillion plus market cap for a few companies that are very strong, has led to strength that Nations did not have before. There is more Wealth & better Standard of Living thanks to those massive successes, including companies that stand for excellence like Berkshire Hathaway; and Apple, Amazon, Google, Microsoft and Nvidia: Additionally all the newer Technology that comprises Blockchains stands at over $1 Trillion: Together those Top Companies that do Good Work, toward prosperity can bring a day where Nations do not have negative 10s of Trillions in Deficits: Instead positive Trillions + in Surpluses. Berkshire is very clearly a company that is on the way to that level and appears to deserve that level of Trillion + overall value, market capitalization: $BRK.A is constantly growing & exercising a level of Good Business that most rivals can only hope to live up to. Disclaimer: This article is not a recommendation to buy or sell and MQ Investment authors and editors have investment exposure to Bitcoin, $HOOD $BRKB $AAPL $GOOGL $MSFT $AMZN $BRKA also their Corporate Bonds, in addition to Cardano, Solana, MATIC, Bitcoin Cash, Ethereum. Please consult a qualified financial adviser to determine proper allocations, if any to investments. |

© 2023