________________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________

| Business Tech Energy Health Finance Economy |

______________________________________________________________________________________________ Advertisement ________________________________________________________________________________________________________________________  AUGUST 24, 2015 The stock market took a dive Monday morning, falling to 15,370 from Friday's 16,459 close. As stocks dropped precipitously in the first half hour of trade, the overall bond market jumped, before both calmed slightly by afternoon. The bond prices settled, while the stock market tested the upper limits of its range. At the end of the day the 10-year treasury yield dropped to 2.01% from 2.05%, the 20-year fell to 2.42% from 2.44% and the 30-year dipped from 2.74% to 2.73%. While, according to the Treasury the 3 month yield jumped back up to 0.06% (where it was mid last week) from 0.03% at Friday's close. From 15,370 the Dow Jones Industrial Average gradually lifted to the 16,000 mark, before jumping to 16,215 around 12:00pm. Monday mornings have exhibited a similar, albeit less drastic trend in recent months. Whereby the market either opens high, or low, then has moved in the opposite direction. By the end of the day the Dow dropped 3.52% to 15,871 and the Nasdaq fell 3.82% to 4,526. Colgate (CL) dropped from $64.98 to $50.84, before rapidly ascending to the $62 range. Procter & Gamble (PG) took a dive from $71.84 to $65.02, before returning to the $70 range. Apple went from $105.76 to $92.00, a $13.76 drop. Apple has approximately 5.7 billion shares outstanding, and has instituted a buyback program. So, the drop this morning represented an approximate $78.43B dollar shift. However, then Apple climbed back to the $100 range, regained the $104 range then rose above its opening price to $108.80 before settling. Apple retook the approximate $78.43B in value, then added about $17B in value. For an approximate total of a $95B range in the first 3 hours of trade. The company's stock closed lower at $103.15, which represents a $15.2B lower market cap for the day. Apple Tries Sailing In Today's Strong Winds $95B is not simply a fortune, it is a greater sum than the GDP of about 124 nations. Though by the end of the day's trading Apple's market cap settled around $587B, from the morning low of approximately $524B.

Source: Apple Investor Relations (8/24/2015) One important consideration is, some investors have set price levels to automatically sell positions. So, major temporary price shifts could affect certain positions more than others. However, some investors are looking for certain levels to buy. Apple was one of the few companies to pull out of the red, from the morning's 6.6% correction, though the company could not sustain the momentum. Some Promotions Of Economic Weakness Hit The Money, Though May Use Broken Clocks Some groups take to promoting market predictions, that sometimes influence investors. For instance one such campaign currently is called: RonPaulUpdate.com, the website appears registered by Stansberry & Associates Investment Research LLC. The Ron Paul promoted advertisement campaign appears on both television commercials and some financial news sources.  According to Wikipedia the publisher of Ron Paul Update: "(created) the 2011 online video and infomercial titled 'End of America.'" While this group has made some accurate predictions, some appear to be exaggerative. The fact is: Predicting the market is dependent on what some call broken clocks. Of course this goes to the old anecdote, broken clocks are right twice a day. Simply to say, the future can not be predicted (unless you have a time machine.) Here is an example of one sponsored advertisement, that appears on Yahoo! Finance's homepage, news feed:

Source: Yahoo! Finance Homepage Some groups promote a certain prediction, and they are right sometimes. Recent promotions have used politicians' likenesses, like Ron Paul, and give the impression the stock market "will" go down. Here is an excerpt from the homepage of the Ron Paul Update site:

One of the objectives of the site, appears to be the sale of books published by Stansberry via a 1 year subscription for $49.95. Notice this excerpt from the Ron Paul Update says: "Research Report #1: The Tax-Free Way to Make 500% in America Today":

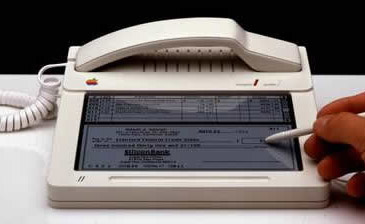

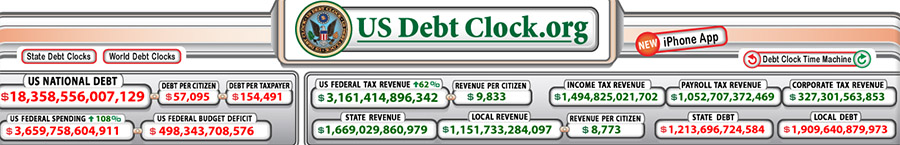

Source: Ron Paul Update Other promotions literally say people should withdraw 'all their money from ATMs.' These types of advertisement campaigns promote the prediction the economy could weaken severely, though some appear to state their prediction almost as fact. The fact is there has historically been a trend for light volume, and overall weakness between May and September. Last summer bucked the trend when the market outperformed. In general this is to say the stock market is underperforming and the market hit a 2,981 total point drop from the Dow's 18,351 March 2015 high, to today's 15,370 low: Or 16.24%, where 10% is considered a correction. Though, the 15,700 level represents a 14.45% drop. While 16,000 represents a 12.81% drop, which would be closer to correction territory. This level is in deed all-important as an economic indicator, though while used often, short-term performance is not necessarily predictive. A new factor can come into play and cause change that can either be positive or negative; this is simply another constant. So, as it turns out the Ron Paul advertisement was right, in the short-term. There is the compounded condition of politics, where current political candidates have seemingly not placed a priority on the economy in general. So, not only is there a recent trend of volatility around political terms, the topic of the economy has not been discussed, because the topic of immigration and personal promotion of candidates has created a tug-of-war between the politicians to curry favor amongst voters. Additionally, it is next to impossible for anyone to utter the words: "Thanks Mr. President, for fixing the economy's broken capacitor." The Economy Owes Some Gratitude To Current Leadership (On Both Sides) Some politicians on opposite sides of the aisle from current executive leadership, have even claimed responsibility for the economic recovery. When it seems the success occurred when both sides eventually came to terms. Both sides of the political spectrum still clash, as has long been the case, however more negotiating appears to have taken place. Additionally Republicans gained control of the Senate, reducing what had turned into a reoccurring showdown between the Republican House and the Democrat controlled Senate. While sides strongly disagree, in the last year they have been able to accomplish the basics. In conjunction with leadership; who, at least, were focused on economic recovery. One campaign tactic for the past several years has been, to be against almost everything current executive leadership has done. The fact is some strategies have succeeded, some have not; which is the case, to different extents, for any political group. So credit is due both sides, though the sensitive transition period in leadership appears to have caused economic waves. In some cases the contradicting views appear intent on making an economic splash. When it's not like if the stock market falls, one political group will win over another. Two main priorities the political and economic debate currently center on are: Taxes and debt. Both sides obviously institute, and use taxes, and handle debt; however some believe the opposing sides center on the needs of different "classes." When the reality is every leader is unique, some manage stronger economies while others do not, due to events both within and beyond their control. The political component of the economy provides for parameters businesses operate within. The political dynamic affects each business' top and bottom line. For instance a new environmental rule could cause some companies to spend more, to bring facilities up to a new standard. While a new tax credit for certain expenses could benefit another company's bottom line. Technology Dependent On Modern Products Apple went from a quality computer company, to the most valuable company in the world in the past couple years. The company experienced hyper-growth, after releasing very popular new inventions like the iPhone in June, 2007.  According to a Mashable article from December 2011: Apple's First iPhone Was Made In 1983, the company made a prototype for a modern phone 24 years before the mobile iPhone was launched in 2007 . The prototype Apple phone was designed almost a quarter century before the iPhone 1, which exemplifies the old saying: If at first you don't succeed..." The overall direction of the stockmarket has displayed an upward trend in the past, however volatility has been a constant. In a recent article: Berkshire Hathaway Ensures Diversification, one quote from the Berkshire Hathaway 1992 annual shareholder letter stood out: Warren Buffett wrote of a golf pro who told him "practice doesn't make perfect; practice makes permanent." Sure, good colloquialisms are nice, though the inspiration and meaning of a certain business principle is a quality that differentiates some of the strongest companies. A company that tries to be permanent, in time, requires a rare type of leadership and to an extent good luck. Politics of Debt Relate Directly and Indirectly to Top Businesses Buisinesses, like Apple, provide: Jobs, benefits, basic services and entertainment to employees and consumers. Additionally major businesses are tied into the world of politics. In general, basic parameters are defined to effectively keep businesses in line. When some company's, in general, in their race to make more and own more, place profit ahead of issues that are deemed important, for instance the environment or consumer health. Though modern tech companies, like Apple, are impacted less in certain areas; for instance Apple contends with some pollution and waste factors, though perhaps less than an energy company that needs to re-outfit facilities to meet new EPA standards. Part of the reason for current volatility, as this article mentions is the current political atmosphere. In addition to expectations for small interest rate increases. Specific to the U.S. economy and a top political priority, the overall debt picture is important; however it can be argued both ways.  For instance $18.3 trillion dollars is a massive amount of debt. Though $57,095 per citizen is not necessarily extraordinary. You see another point of view could be (and is) "$18.3 trillion, that's extraordinary!" However, rarely do these arguments argue whether $57,095 is extraordinary or not. According to the Debt Clock federal revenue is approximately $3.1 trillion, so while $18.3 trillion is a large figure, there is an amount relative to that number to calculate. Additionally the quality of debt has remained Aaa/AA+. Though, particularly in the case of large nations, there is more leeway. Whereas a business might struggle more with the ratio presented by the U.S. debt scenario. Whereby annual revenue is approximately 5.8% of total debt. The fact Apple and several other companies took a sharp dive and flew back up could be viewed as a positive. However, the fact remains that the market is unpredictable, it goes up and down, and can be volatile. Quality depends on many things, including profitability, leadership who can weather a storm and also maintain each company's vision for their future. There is of course still business being done, whether the market is on the rise or takes a downturn and some businesses can find success during periods of economic volatility or contraction. The fact these companies took such a brief, sharp turn today can either mean they hit their floor or it could mean they have any amount of downside (or upside.) It simply depends on their performance and favor with major investors. Investors focused on long-term buy, hold and dividend reinvestment may not be as concerned than those who are swayed by predictions. Though, rate of growth is a particularly important factor for even the most conservative portfolios. Apple Resilience In Line With Overall Market Today, Future Is Unwritten The sharp market downturn this morning and the overall week-long downturn is simply illustrative of the potential for the economy to shift. It is disconcerting both sides of political candidates are not exactly determined to reinforce the benefits of successful economic leadership, that has benefited from some of the arguing; however is clearly defined by the executive branch. This is to say: Sure, some aspects of any administration are imperfect, some are viewed more favorably by one side and less by the other side. However, if the market performs superlatively, then that is good for businesses and the public. Where the economy goes from here can not be predicted, though there is a case for some strength during the latter part of the year. The old anecdote about investors returning on St. Leger's Day, goes to a horse race; the last of the season, founded in 1776:

Some investors cite that on average "sell in May and go away, don't come back 'till St. Leger's day" is a successful strategy. While others believe dividend reinvestment during summer downturns actually provides for a contrary strategy. The secret is, there is no particular magic recipe to investing. Some strategies work for some investors, others do not. There are basic principles to contemplate in terms of what differentiates strong performance from poor performance. Keep in mind, again, the market is simply unpredictable; companies that make a lot of profit may be appealing, however investors do not ever know for sure how successful they will continue to be. Apple may appeal to some investors because the company has been able to maintain strong levels of profit, averaging approximately $12.6B net income over the previous 4 quarters. Apple's net income declined in 2013, from 2012; however gained in 2014, though not quite to the level of 2012. While revenue has built steam over the past 3 years, cost of revenue has increased, from $87.8B in 2012 to $112.2B in 2014. Selling, general and administrative costs increased from $10B in 2012 to approximately $12B in 2014. Apple's research and development expense rose from $3.3B in 2012 to $6B in 2014. Apple and almost every major publicly traded company was affected by today's early sell-off. At this point one reality affecting the economy is political rhetoric, rather than economic focus. Though there is certainly potential for disingenuous economic platforms, whereby some make promises that aren't kept, or say what they think voters want to hear. A constant sentiment is that there is potential for some political groups to put certain interests ahead of others. While it actually appears there is some balance with Democrats leading the executive branch and Republicans in control of legislative. Clearly some politicians are acting as if everything is really broken and only they can fix it, rather than pointing to actual major economic or political problems that were broken, that they actually fixed; or so it seems. When advertisements claim "the truth about the economy is terrifying" using a well known politician like Ron Paul, and when the economic rebound was a priority of another group of politicians, and when past transitions from one politician to another have yielded volatility; it is clear the political dynamic is central to the economy. It is particularly odd that politicians who effectively had / have more control, than anyone else, contribute to such campaigns and it seems in general the Ron Paul campaign, via Ron Paul Update attributes some of the cause to previous and current administrations in general. With, perhaps, more finger-pointing intended at the current administration, who incidentally helmed the largest economic rebound in history. Politicians like Ron Paul are entitled to their opinion, though it is not clear the sentiment is widely agreed upon within top business circles. Whereby some top businesses appear to be more optimistic about the future of the economy. Though neither Ron Paul, any business, or investors have a crystal ball. The work falls on the shoulders of corporations like Apple and contemporary large businesses and small businesses, to attempt to thrive regardless. As it has been during several corrections and downturns since the stock market was founded. Disclaimer: This article is not a recommendation to buy or sell. Mark Quarter Investment News authors hold Apple stock and / or have exposure to Apple stock & bonds through funds. Please consult a qualified financial adviser to determine proper allocations, if any to investments. |

| Business Tech Energy Health Finance Economy |

© 2015