________________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________

| Business Tech Energy Health Finance Economy |

______________________________________________________________________________________________ Advertisement ________________________________________________________________________________________________________________________

SEPTEMBER 24, 2016 Janus Capital (JNS) is currently trying to sell their INTECH line of so-called "managed volatility" funds. Janus is the 14th largest shareholder of Altria (MO) so it is no surprise to see the top holdings of their INTECH U.S. Managed Volatility (JRSAX) fund include Altria and Reynolds (RAI). The surprises literally stop there because in Janus' profile page for the fund they leave an empty column where they have labeled "top holdings (% of fund)."

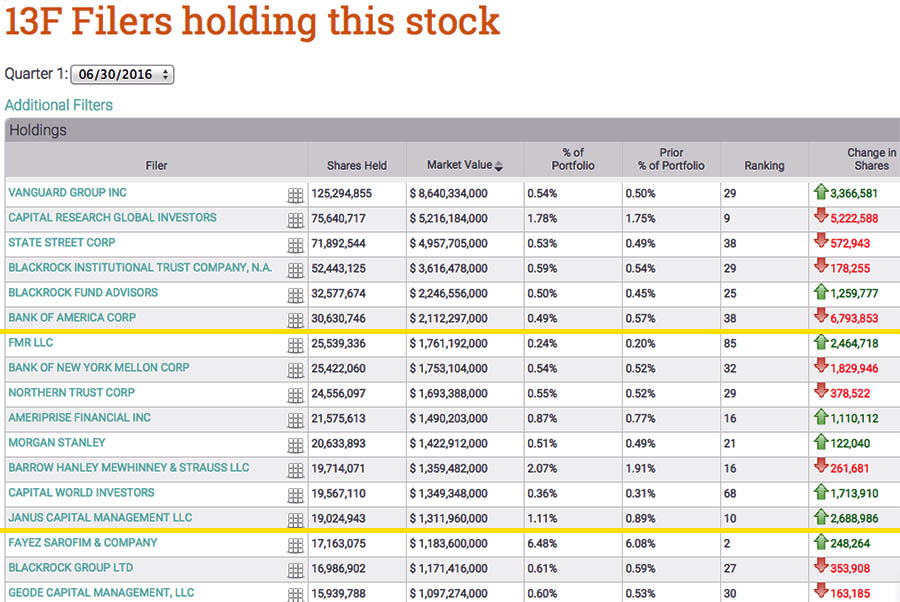

So to the right of the names of the top holdings there is no data, whereas the chart is labeled "top holdings (% of fund)." This indicates that beside each of the top holdings there would be the amount allocated, which is very common, though Janus leaves it blank, however lists that the top holdings comprise around 18% of the fund's total assets. On the profile page there is a link to the full holdings, and once more there is just a list and no data on how much is allocated to the holdings. A search of the full prospectus for "Altria" turned up no results. Simply put it is surprising to see the allotment to tobacco in the top holdings of Janus' "managed volatility" funds. When the most recent data shows major North Carolina based financial firms like Bank of America dropped Altria like a rock, selling 6.7 million shares in the previous quarter.  Source: Whale Wisdom The largest owner, Vanguard piled on more shares to their massive position in Altria. Though Vanguard manages approximately more than 10 times the amont Janus does. Comparatively, Vanguard's Global Minimum Volatlity Fund (VMVFX) does not count tobacco as a top holding. Vanguard's Global Minimum Volatility Fund, also, does not list Altria, Reynolds or Philip Morris in their full holdings either, it does however hold a smaller Florida-based tobacco company. Tobacco Is Definition of Volatility When Brexit took place there was an immediate drop in the global markets, except for Big Tobacco. Though, the underlying condition of the industry is by far not without risk. Some believe tobacco is a safe haven because of previous performance. As well, tobacco companies are perhaps focused on rewarding shareholders especially because their products cause a lot of harm. So the "rewards" and profit are supposed to excuse that fact. When people who smoke or who are exposed to the smoke of Altria and Reynolds cancer sticks often succomb to tragic, incurable and devastating diseases. The results of exposure to Altria's and Reynolds' Marlboro and Camel cigarettes is often medically severe. So, on the bright side Altria and Reynolds apparently try to make their shareholders happy with gains. Thus it is common for tobacco shareholders to be defensive when their companies are criticized, because it seems like easy money. The problem is given the fact that so many people are either seriously injured or die from Altria and Reynolds' products there is enormous potential for liability, and the tobacco companies have had to pay very large settlements. So long as enough powerful politicians will turn their backs, and ignore the effects of the tobacco companies' products, though, some investors believe tobacco companies may be able to sail smoothly. Additionally, and importantly, the tobacco companies have entered a new market of flavored vape e-cigarettes, that are thought to be potentially less carcinogenic. So, it is not like the companies are not exploring some less deadly alternatives. Still the vast majority of the business is smoked and chewed tobacco, that is infused with loads of sugar and candy, which makes them incredibly more addictive and harmful. Altria and Reynolds have made their products so strong that people are physically addicted and can not quit. Tobacco companies act like that is great, while the lobbyists are just doing as they are told. While the tobacco-controlled politicians appear to have made it a top priority to stall the Bills that could attempt to emphasize the importance of not smoking, and tobacco cessation for those who do. To the point that Senate Majority Leader McConnell has halted his own party's 21st Century Cures Act and End of Breast Cancer Act S.746 from the more senior members of his own party. So that no American is ever encouraged to avoid tobacco, as part of an effort to prevent incurable, lethal diseases. So instead of representing the majority of people from their own states the tobacco-controlled political leaders act like hand puppets for the tobacco lobby. The tobacco lobby dollars apparently are contingent on the tobacco-controlled politicians like Senate Majority Leader McConnell making sure that no American ever benefit from what the Republicans' 21st Cures Act wanted to accomplish or S.746 the End of Breast Cancer Act wanted to accomplish. Because those tobacco-lobbying pennies added up and were apparently more important to the Senate Majority Leader than any attempt to stop tobacco from causing as much harm as it does. Tobacco Lobbying To Prevent Bills That Might Warn Of Harm Caused By Cancer Sticks  Former House Speaker John Boehner, who used to hand out checks from the tobacco lobby to Congressmen as they voted on legislation about tobacco, recently joined the board of Reynolds. While both the House Majority Leader, Kevin McCarthy (R-CA), and Senate Majority Leader Mitch McConnell are funded by the Tobacco Lobby. Senator Richard Burr of North Carolina is the top recipient of the tobacco lobby. As well vice-presidential candidate, Senator Tim Kaine (D-VA) is one of tobacco's top recipients. While his opponent, Gov. Mike Pence of Indiana actually campaigned once for Congress on the platform that "smoking does not kill." (Mike Pence's political career was partially funded by donations from a family business called Tobacco Road that went bankrupt during the height of the bull market in the mid-2000s.) Some might look at the current political confrontation as a win/win for tobacco and the genocide caused by Altria & Reynolds' Marlboro and Camel cancer sticks. They bought representatives on both sides of the aisle who are paid to prevent regulations of tobacco and ignore complaints about the awful, incurable diseases caused by them. In Kentucky 25,205 men, women and children die each year of cancer according to the National Cancer Institute. The Kentucky Senator Mitch McConnell gets an annual donation from the tobacco lobby that amounts to approximately 1 penny for each American who has died of tobacco-related-diseases every few years. So between smokers, non-smokers who develop diseases from exposure to second hand smoke, those who develop diseases prenatally, and then non-tobacco caused diseases that are drowned out by the tidal wave of tobacco-caused cancers, the amount Senate Majority Leader McConnell gets each year relative to the mortality in Kentucky is around $200 from Big Tobacco. For childhood cancers alone, in Kentucky where one youth died every 40 hours on average last year, the amount of the tobacco donation to Senate Majority Leader McConnell was approximately $2. Thus another reason that appears to side with the logic of Bank of America, headquartered right there in North Carolina, to drop that Altria like it's a bag of hot potatoes. Sell em like there is no tomorrow and get as far away from the Big Tobacco Genocide as possible and certainly not try to sugarcoat it with "managed volatility." So, while Senate Majority Leader Mitch McConnell's own party passed the 21st Cures Act, a Bill that specifically targets childhood cancers in addition to all diseases, Senator McConnell will have none of it. Instead the Bills that might remedy the genocide caused by Altria and Reynolds Marlboro and Camel cancer sticks are ignored. Mathamatically the donations from the tobacco lobby amount to just a few cents per person who dies each year, to apparently some of the most greedy politicians, like Senator Mitch McConnell. So, while the great majority of Congress, 272 House Represenatives and 51 Senators, of the 435 total House Reps and 100 Senators have co-sponsored legislation like Accelerating the End of Breast Cancer S.746 in the Senate from a Senator more senior than Majority Leader McConnell, Kentucky politicians have overruled them. These are Republican Bills being halted by less senior, but more powerful, Republican leaders at the behest of the Tobacco Genocide Lobby. So dozens and dozens of politicians from the bigger states are backing the 21st Century Cures Act and End of Breast Cancer Act, however the tobacco-controlled politicians are faking out their own party and their own voters, while Americans are continually harmed and die from the products made by the companies that are trying to buy that exact type of negligence. So there will be no 21st Century Cures Act H.R.6 and no End of Breast Cancer Act H.R.1197, S.746, passed by the tobacco-controlled leaders, who are fewer than the Bills' supporters. All to make sure that Altria and Reynolds can be free to addict as many Americans as possible to their cancer sticks. Is Bank of America Right To Drop Altria Like A Rock, Considering Tobacco's Maximum Volatility? Possibly the recipients of the tobacco lobby dollars, and former House Speaker Boehner and current House Majority Leader Kevin McCarthy and Senator Richard Burr of North Carolina and the Senate Majority Leader Mitch McConnell have not calculated how much their tobacco funds amount to per American who has died because of the Altria and Reynolds cancer sticks. They may not realize that the pediatric cancers too, are too often caused by Marlboro and Camel cancer sticks. Not realizing that is how lethal the carcinogenic smoke from the cigarettes is. Or perhaps the political recipients just ignore the research. Though the economic fact is that each of the tobacco lobby recipients are exchanging the health and lives of Americans who develop and die from tobacco-related-diseases, for a few pennies or less. For some reason even though so many Americans have died from Altria and Reynolds' products, investors and politicans line right back up. Not wanting to know or simply not caring what Altria and Reynolds do to try to make their Marlboro and Camel cancer sticks ever more addictive, to the point that now sugar and candy are loaded into each cancer stick. To try to push those cartons off the shelves, until their customers' dying breath. Quite simply no other company's business model is remotely as detrimental to public health, and Altria and Reynolds have no rivals to the number of casualties caused by their products. The Bottom Line In today's economy it is common for funds to have some exposure to Big Tobacco. For some investors this is an automatic reason to either invest or not invest. Some even invest and hope that they can add their opinions that tobacco companies should work to completely eliminate addictive additives and work to drastically reduce diseases caused by their products. Though for a "managed volatility" fund such as Janus' U.S. Managed Volatility (JRSAX) to include heavy exposure to both Altria and Reynolds, with their fellow INTECH brand of funds holding Philip Morris International (PM) as top holdings; then to dance around things like listing the percentage of the holdings, while top North Carolina based financial institutions like Bank of America are dropping companies like Altria, appears ill conceived. The fact is Janus holds so much Altria it may seem natural to spread it around through their funds. As well Janus does have some O.K. funds, however it so happens they would have been far better off throwing money into companies that do not cause genocide. If Janus had gone with a top tech company instead, it turns out they would have done great. In terms of "managed" volatility there are a few companies considered to be more stable in uncertain economic cycles, that again don't harm so many people and create a system within the political sphere whereby huge death tolls from Altria and Reynolds products are tolerated, so long as the tobacco-controlled politicians are getting their donations. Investors can not be expected to know every dimension of any given company they have exposure to. Though with tobacco companies like Altria and Reynolds there is simply a lot of suffering and a network of donations in exchange for selling out the voters who elected the politicians to begin with. The fact is also that the politicians controlled by Altria and Reynolds tend to treat American voters awfully. Almost as if they: Had to do, what they had to do, to win politically. Even if that means being dictated to by the tobacco lobby instead of listening to or acting on behalf of their own voters. The fact is that each hour the list of tobacco casualties adds more people. The side that has the control in the United States Congress, the Republicans, actually has put together legislation to stop that trend in the 21st Century Cures Act H.R.6 and Bills like S.746 End of Breast Cancer Act, however they are a no-go, because of the tobacco-controlled politicians like Senate Majority Leader McConnell. So, when investing in Big Tobacco the take away is that the entire business is centered on trying to work around the awful fact that the product, is part of a political machine that appears to ignore and dismiss the tobacco-caused incurable diseases that take the lives of tobacco customers and people exposed to the Altria and Reynolds second and residual (third hand) smoke. The fact that the tobacco lobby has actually succeeded indicates that their ability to control political systems is, for better or worse, effective. Though the fact Big Tobacco does not even try to set a standard represents priority placed on profit above all else, including the lives of people exposed to their products. Whereas a company like McDonald's (MCD) for instance recognized warnings from medical experts and set maximum levels of fat in their fast-food. Tobacco appears determined to constantly push the limits on making their product more addictive. Rather than taking steps to either offer or set a universal standard for lower addictiveness and elimination of additives used to cause physical dependence. Thus allowing people to have a smoke or vape, that is not primarily designed to cause maximum addictiveness. While many businesses recognized that longer living customers do business with them for longer periods of time, that apparently has not caught on in the tobacco industry. Making the number of deaths that can only be described as "genocide" caused by Big Tobacco, that much more unfortunate. To the point that according to the statistics, some politicians have been bid down to the point that the going rate for excusing tobacco-caused deaths is around one penny in tobacco lobby donations. Disclaimer: This article is not a recommendation to buy or sell. Please consult a qualified financial adviser to determine proper allocations, if any to investments. |

© 2016