________________________________________________________________________________________________________________________________________

| Business Tech Energy Health Finance Economy |

______________________________________________________________________________________________ Advertisement ________________________________________________________________________________________________________________________ Amazon Affirms Bull Thesis

Amazon's Fire Phone taps into Amazon's Instant Video, Kindle Books & Amazon Music July 24, 2015 Amazon.com Inc (AMZN) opened up $96.71 a share, or 20% on Friday after reporting Q2 2015 earnings. As the overall market receded, Amazon stock eased towards a middle ground between a high of $578.89 and Thursday's close. Amazon began the year at $310 a share and is currently trading at $529.49, up 70% . The $219 a share gain represents a market cap increase of approximately $101B. This places Amazon in the same ballpark of growth as Google (GOOGL) which gave up 6% in the first few days of 2015, only to climb 40% from $497.06, on January 12, 2015, to $699.62 on July 17th. In Google's case the company rose from $337B market cap in mid-January to $459B. Relative to Amazon's current market cap of approximately a quarter trillion dollars. Amazon has performed extraordinarily well in the past 6 years. In August 2008 Amazon traded at $80 a share, and dropped to $42 during the market downturn. From Q3 2008 to Q4 2008 Amazon's market cap decreased from $33.1B to $21.6B. From November 2008 through April 2009 Amazon jumped right back up to $80 and kept climbing. Among investors there is a lot of polarity on Amazon. They generally either enthusiastically favor Amazon, or strongly dislike the company. Often the source of concern are metrics like P/E. Amazon's revenue has been strong for years, going from $61B in 2012 to $88.9B (an approximate 45.7% increase) in 2014. While cost of revenue increased from $45.9B in 2012 to $62.7B in 2014, a 36% increase. Selling, general and administrative costs went from $14.4B in 2012 to $26B in 2014, up 80.5%. So revenue outpaced cost of revenue however selling, general & administrative costs soared. Therefore Amazon did not turn a profit in 2014, as the company did in 2013. Much depended on the success of the projects Amazon was developing. Amazon, Back to Basics  Amazon's new products appear to make "roughin' it" a lot easier. Amazon is developing rapid delivery with its new Prime Now program. While a few new products that tap into Amazon.com's media are hitting the market. Fire TV and Fire Stick can turn any TV or projector with a HDMI port into an on demand movie theater. Both products are compatible with Amazon's voice controlled remote, which is standard with Fire TV. Remember when people had to switch from channel to channel to see whether something good happened to be on? If you were lucky you could catch the last 1/4 of a great movie. Or, you could open the newspaper, pick a program in advance and plan to be in front of the TV, where you could watch the show along with several minutes of commercials. Back then you could try to clear your schedule weekly, to catch your favorite show, occasionally missing an episode. Cable TV programming is much the same today, though content producers appear to have benefited from the on demand phenomena. To put the phenomena in perspective let's take a look at the timeline. In 1971 Sony (SNE) introduced a video recording & player system, the U-Matic VO 1600 for $1,395. Blank tapes cost $35, to put this in perspective $1,395 in 1971 would be $8,219 today adjusted for inflation. In 1972 Philips (PHG) made a less expensive competing product, the N1500. In 1976 JVC (Victor Company of Japan, now JVC Kenwood) introduced the Victor HR-3300 the first VHS tape based home recording system. LaserDisc was first introduced to the general public in 1978. The technology was developed in 1958 and patented in 1961. VHS became the standard between 1976 and the early 1990s, when Video CD was introduced in 1993 followed by DVD in 1995. Netflix (NFLX) began mail order DVDs in 1997 and then TiVo came along in 1999. Amazon Instant Video arrived in 2006 and Apple TV was introduced in 2007, the same year Netflix started their internet streaming program (a service that ultimately began using Amazon Web Services.) Google Chromecast was released in July 2013 which streams content from computers to A/V equipment. Amazon's Fire TV followed in April 2014 and Fire Stick was introduced in November 2014. Amazon's Edge Amazon's edge is their established marketplace. What gives the marketplace an edge are potentially better deals than competitors. Additionally, Amazon's products appear to have succeeded on two important counts: They are easy to use and they are aesthetically pleasing. Take the remote control for instance, it is simply designed, comfortable to hold and very basic compared to remotes with 20 or more extra buttons aside from number buttons:  While products like Fire Phone and Kindle are popular, they entered the smart phone and tablet markets to compete. Whereas Echo hopes to popularize the newer voice command device market:  Amazon's willingness to compete in the realm of smart devices may be a reason why bulls were optimistic and bears were pessimistic. Those opposed to Amazon, perhaps saw quarterly losses as signs of failure, risk and potential for worsening losses if endeavours were not successful. While bulls focused on revenue growth and were optimistic Amazon used funds wisely. Kindle was not simply another tablet considering it is a platform to read material from Amazon. Whereas Echo is entering a slightly newer field altogether. There already are devices for home automation, however Echo branches into audio entertainment and personal assisting. One such competitor on the home automation side is VoicePod Zigbee by HouseLogix, which retails for $649 compared to Amazon's Echo at $179.99 (with an optional voice remote control for $29.99 and $39.99 for a 2-year protection plan.) Echo performs tasks similar to Apple's Siri, whereby Amazon's device can answer questions, select and play examples of a requested music genre and add items to lists or calendars. While one reason for Amazon's 10% jump after Q2 earnings was overall quarterly revenue growth, particularly from Amazon Web Services, successful products contribute to the overall picture. Echo is dependent on Amazon's cloud computing capabilities and is promoted as "getting smarter" because it is hooked up into the cloud. Here is an excerpt from Amazon's customer reviews:

Here are examples of WeMo products by Belkin, a private consumer electronic company based out of California.:

So, not only are these inventions convenient and futuristic, they are practical for consumers who have difficulty ambulating. Some drawbacks to Amazon's Echo, that may not be as apparent involve security (some Echo users are already incorporating a personal home firewall in addition to Echo's standard layer of protection.) For instance automakers are encountering potential for software exploit, with CNN recently reporting computer experts tested a new vehicle and were able to take control, using the vehicle's Wi-Fi. Similar worries could accompany devices like Echo, though equipped with a microphone off mode whereby Echo illuminates in red to let the owner know the microphone is disabled. Some consumers may worry such a device could be exploited. Still this criticism applies to products like smart phones and has not stopped them from being wildly popular, as manufacturers work to constantly improve and fix potential loopholes. Cloud Wars Amazon Web Services has recently received more competition from Microsoft (MSFT) and Google. Fortune Magazine recently published:  Again, Amazon appears to benefit from its own well established marketplace. Amazon can use their experience as a model for what customers of AWS require to sustain their online businesses. Here is Amazon's own definition of the cloud:

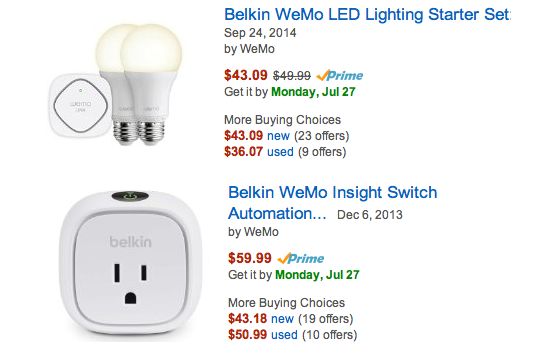

Source: Amazon Web Services Amazon's Q2 report shows AWS quarterly net sales growth increased 81% year/year:  Source: Amazon Q2 Press Release So, while AWS only accounts for 8% of Amazon's reported net sales mix, the rate of growth is substantial. North America accounted for 59% of the net sales mix, while International sales growth appears to have plateaued, dropping from 18% growth in Q2 2014 to 3% growth in Q2 2015. Therefore the timing of AWS' success worked to compensate in terms of the overall growth picture. From Delivery to Original Content Amazon started as an online book seller, before becoming a one-stop shop for authors & publishers. Take a look at the Royalty Calculator on Create Space, this shows the projected profit a publisher can expect if they produce and sell a 100 page, 7'' x 10'' black and white printed book for a purchase price of $10:

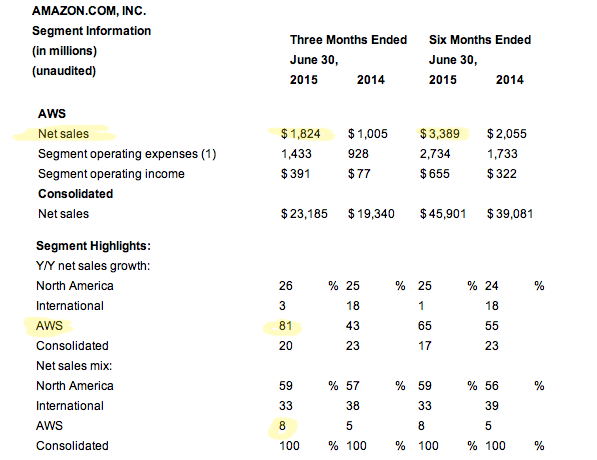

Source: CreateSpace Royalty Calculator In addition to Create Space for book publishing, the service works for musicians and filmmakers. Four years after Amazon introduced Instant Video, the company built Amazon Studios in 2010:  Amazon Studios accepts submissions and includes a Storybuilder and storyboard tool:  Source: AmazonStudios Competing tech companies also focus on entertainment. Apple iTunes works with musicians, Google bought YouTube which is a destination for filmmakers, talk shows, news and musicians. Whereas Amazon's entertainment segment offers a more classic form of content delivery, and unique platform for content production. Generally content production is a tough business, first the content needs to be good enough to attract an audience that can support the material. Amazon is truly unique in that their service does not depend on commercials, compared to Google's YouTube for instance. The difference between Amazon and Google's models may seem obvious, however hold important considerations for investors and businesses. An important distinction is that Amazon offers a lot of content as a complimentary benefit of subscribing to Amazon Prime. Some reports estimate membership in Prime is nearly 40M compared to YouTube's estimated 1B+ users. If paid Prime membership is close to estimates it is easy to see how Amazon Studios' content, that is often free for Prime members, is supported. Amazon Services Expanding Amazon does not appear to be struggling at this point. In fact the company's meteoric rise is one for the history books. From a business and investor standpoint, it is important for Amazon to stay on top. One area Amazon is exploring is home services:  Source: Amazon Home Services It is worth noting Amazon is currently encountering a complaint over their Amazon Local service, which is similar to Amazon Home Services. Angie's List (ANGI) has complained Amazon employees, allegedly, scoured their website and contacted businesses using Angie's List's contact system to ask them to move to Amazon Home Services. Amazon is a major powerhouse compared to Angie's List, which recently dropped 25% after disappointing on revenue growth. Amazon is 1,000 times bigger than Angie's List in terms of market cap. So, it seems unnecessary for Amazon to engage in such tactics, if they are accurate; effectively copying Angie's List's homework. Particularly given the fact businesses that use Angie's are often searchable independently and can be contacted via their own sites. Competition can be fierce and even quote-unquote "fair competition" can hurt small businesses. The prime example being Wal-Mart, however Amazon took on Wal-Mart and appears to have succeeded. Though Amazon may have pushed some smaller bookstores down, several book sellers have utilized Amazon.com as a marketplace for their products. While Wal-Mart is less known as an avenue for independent retail, catering more to large corporations and mass production, Amazon has provided a platform for individuals, small, medium and large cap companies. This spectrum is a major component of AWS also. The Bottom Line This summer's earnings have proven difficult for large caps, with a few exceptions. Notably Apple, Microsoft (MSFT) and Biogen (BIIB) fell after reporting, Biogen dropped 20%. Google and Amazon fared much better, though Amazon had a tough time holding onto the full gain and Google took a dip on Friday after skyrocketing. Moody's issued the following statement after Amazon issued new debt last December:

Quite frankly Moody's concern was understandable last December, except for the fact interest rates were so low. Making the issuance of debt seemingly more sensible, Amazon's Q2 2015 report stated $8.25B long-term debt (and $8.5B in "other long-term liabilities") with $10.2B cash & equivalents and $3.7B in marketable securities. General and administrative costs were listed as increasing from $377M in Q2 2014 to $467M, or up 23.8%, in Q2 2015. That rate does appear to coincide with favorable revenue growth, according to performance after earnings were released. Here are a few of Amazon's corporate bonds, as they currently stand on the secondary market:

In the next quarter it is important to follow the performance of Amazon's products and of course their services. Echo in particular has potential, though the popularity of this product is not yet known. However, it appears Echo has made a good first impression. Additionally Amazon is set to encounter more competition, particularly from a new wholesale online marketplace as CNN reported in "Jet.com takes aim at Amazon and Costco." Also important are Amazon's plans for their Prime service, products like Fire TV and Echo could be a benefit, because Fire TV requires Prime and Echo could be incentive for customers to add Prime membership. Concerns with Prime include reduction of benefits, some Prime products that have been 2-day shipping in the past year, are now only available for standard shipping. This could be due to availability, however the 2-day versus standard delivery is fairly important for Amazon. To an extent Amazon affirmed the bulls' thesis, however by losing half of its gain on Friday also catered to those who view the company unfavorably. Reasons for an unfavorable view include Amazon's ability to drive down competing businesses, thus countries like Argentina imposed major restrictions on Amazon. In June 2014 BBC reported: "Argentina restricts online shopping as foreign reserves drop." According to the BBC article Argentina is making customers pick up packages from Customs offices. The precise reason for the drop year over year in international revenue growth is not clear. During the earnings call Amazon's CFO stated:

One reason for lower growth internationally could be overall sentiment that Amazon can drive down small businesses (and even larger businesses in foreign markets.) Additionally some foreign currencies have not fared as well in the past year against the dollar. Amazon's CFO continued:

Amazon seemingly does have potential to actually enhance business internationally, for themselves and for those foreign markets. Though especially in these markets it is important for Amazon sellers (for instance a seller based in Argentina selling in Argentina and internationally) to be able to earn enough to make business worth while. However, it is a given that foreign markets are complicated for a number of reasons, emphasis might be placed on potential for Amazon.com to improve economies. Disclaimer: This article is not a recommendation to buy or sell. Mark Quarter Investment News authors hold Amazon stock and / or have exposure to Amazon stock & bonds through funds. Please consult a qualified financial adviser to determine proper allocations, if any to investments. |

| Business Tech Energy Health Finance Economy |